Simple explanation for Payment Systems in Uganda

Understanding the Different License Categories Required for Payment Systems in Uganda: A Simplified Guide

The National Payments Regulation, 2021, supervised by the Bank of Uganda, is responsible for issuing licenses to entities operating payment systems in the country. However, understanding the different categories of licenses can be confusing for those unfamiliar with the regulations. This article aims to provide a simplified explanation of the three main categories of licenses issued by the Bank of Uganda: Payment System Operator (PSO), Payment Service Provider (PSP), and Issuer of Payment Instrument.

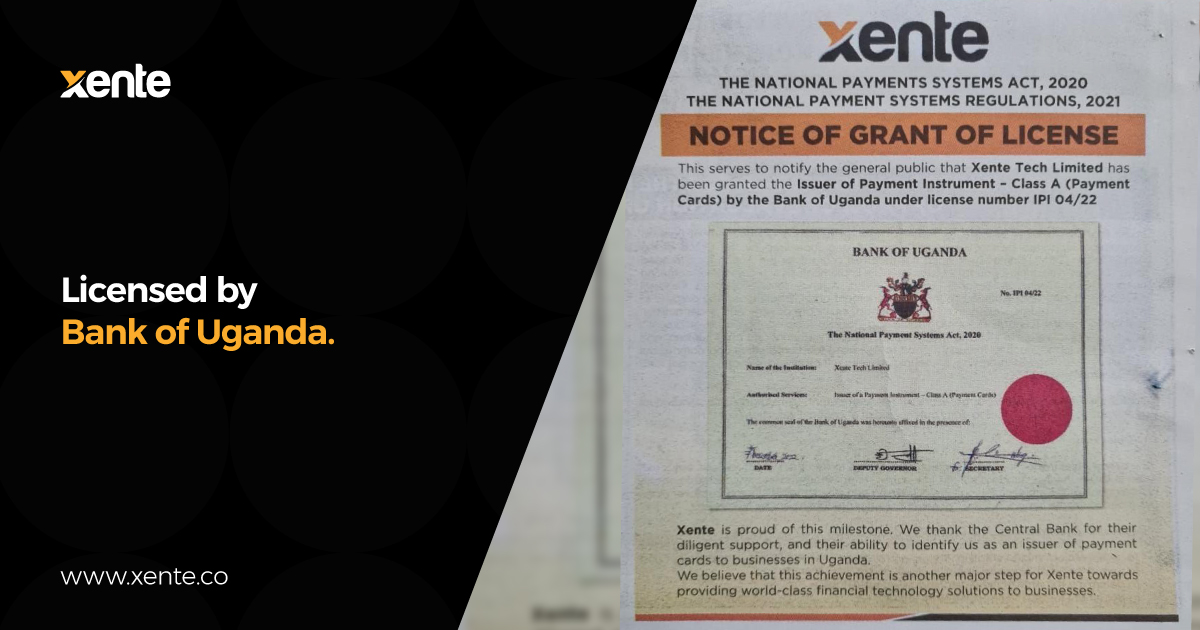

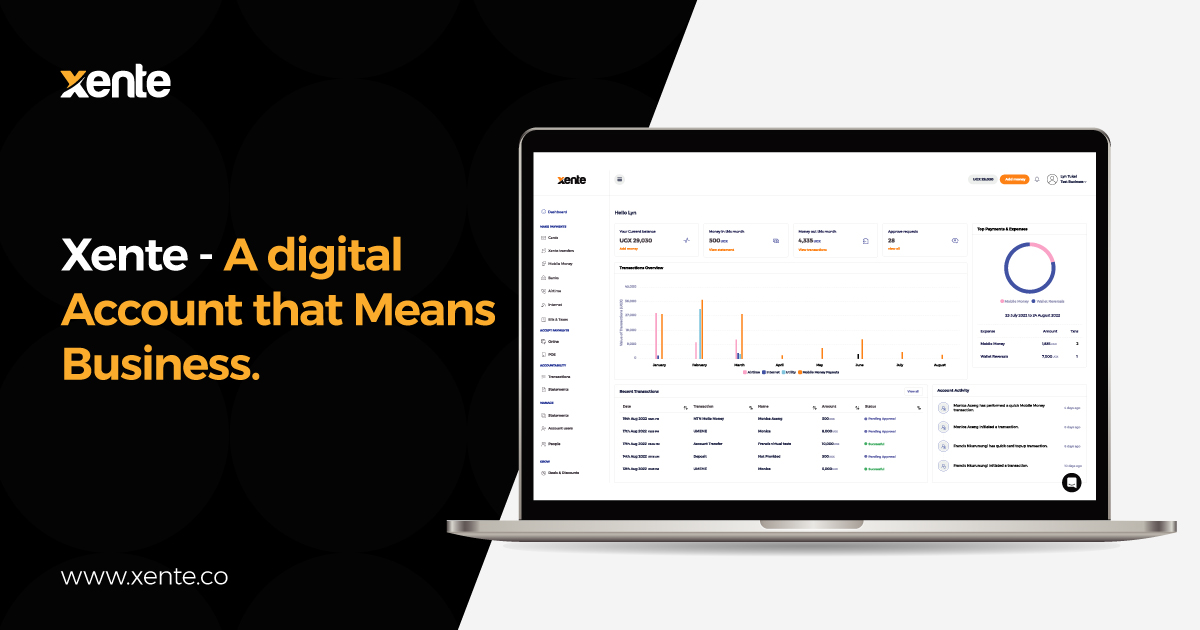

Payment System Operator (PSO) license: This license is required for entities that operate systems that transfer funds between individuals (P2P), businesses (B2B), and government (B2G). P2P refers to person-to-person payments, where funds are transferred between two individuals. B2B refers to business-to-business payments, where funds are transferred between two companies. B2G refers to business-to-government payments, where funds are transferred between a company and a government entity. This includes platforms like payment gateways and integrations that collect money on behalf of customers without the need for them to set up an account. An example of a company that holds this license class is Xente, which facilitates business payments.

Payment Service Provider (PSP) license: This license is required for companies that issue electronic money (and/or tokens) as a store of value. Examples of companies that hold this license class include telecoms like MTN Mobile Money, Airtel Commerce, Safe Boda and others. These companies typically facilitate their customers to hold electronic money – you can go to an agent, give them cash, and receive electronic value in return. These electronic values can be used for various transactions like sending to other people, mobile airtime purchase, bills payments, and other payments.

Issuer of Payment Instrument license: This license is required for entities that issue payment cards or other electronic devices as a store of money for payments.. Payment cards are used to make electronic transactions and pay for goods and services. Xente, for example, issues cards powered by Visa and also holds this license class.

It's important to note that this article is intended as a simple explanation of the different license categories.

For in-depth and more accurate information, please consult the Bank of Uganda website or seek expert legal advise. It's advisable for any company looking to operate in the payment system space in Uganda to check the requirements for each license category and the specific regulations that apply to their business model before applying for a license